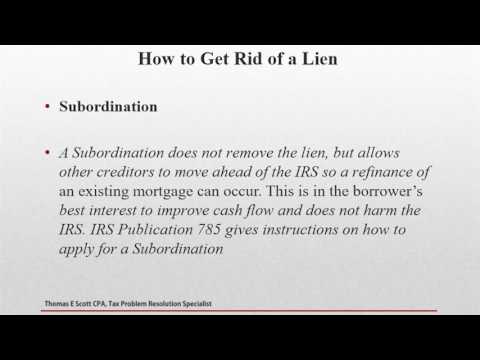

Hi, this is Tom Scott, CPA. Today, we are talking about understanding federal tax liens and how to get them released. Welcome back! Before we begin, I want to draw attention to the two buttons on my blog: "Secure for a free tax relief consultation" or "Click here to view my free tax which North's library." Now, let's get back to our topic of the day - understanding federal tax liens. A federal tax lien is the government's legal claim against your property when you neglect to pay taxes. The lien protects the government's interest in all your property, including real estate, personal property, and financial assets. The federal tax lien exists after the IRS does the following: first, they put a balance due on their books and assess your liability. Next, they send you a bill that explains how much you owe, called a Notice of Demand for Payment. If you neglect or refuse to pay the debt in time, the IRS files a public document called a Notice of Federal Tax Lien to alert creditors that the government has a legal right to your property. Here's how a federal tax lien affects you: 1. Assets: The lien attaches to all your assets, including real estate, securities (such as stocks), vehicles, etc. This also includes future assets acquired during the life of the lien. 2. Credit: When the IRS files a Notice of Federal Tax Lien with your county recorder, it will limit your ability to get credit. It can make refinancing a home nearly impossible. 3. Business: The lien attaches to all your business property, including any and all of your accounts receivable. 4. Bankruptcy: If you file for bankruptcy, your tax debt lien and Notice of Federal Tax Lien may continue after the bankruptcy. Now, let's talk about how to get rid of a lien: 1. Pay...

Award-winning PDF software

Publication 785 Form: What You Should Know

You can now complete your own copy online as you complete tax forms or printable PDFs If you don't have a computer or printer, you can download a copy online for free.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Publication 785, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Publication 785 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Publication 785 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Publication 785 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form Publication 785